Trump Accounts

- Get $1,000 for every American child born between January 1, 2025 and December 31, 2028.

- The account is fully in your child’s name, and you are the sole custodian until they turn 18.

- No contributions necessary—but you can deposit up to $5,000 per year to maximize growth.

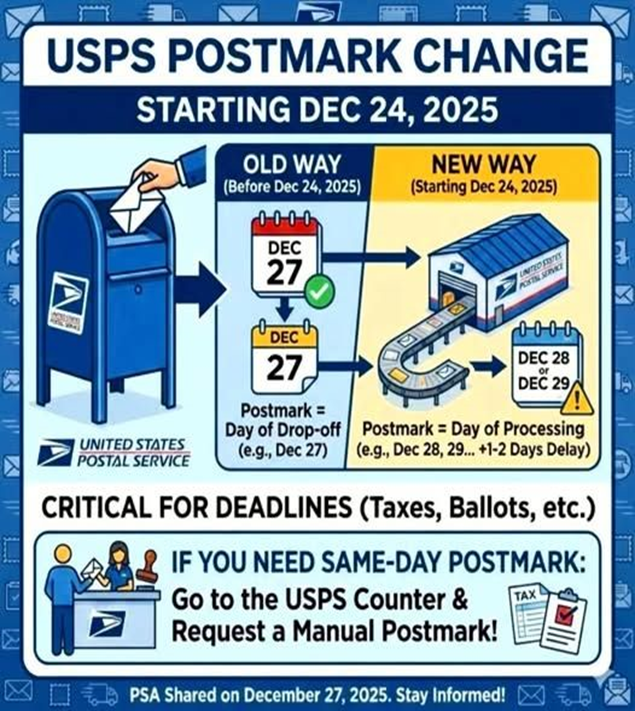

USPS Postmark Policy Change

The U.S. Postal Service (USPS) recently changed its postmark policy (effective December 4th, 2025) so the date printed reflects when mail is first processed by automated machines, not when you dropped it off, potentially causing a delay of a day or more. This affects time-sensitive items like tax returns, ballots, and bills, as the official postmark date could be after the actual mailing date. To ensure your mail is postmarked on the drop-off day, you must request a manual, hand-stamped postmark at a post office counter.

Key Tax Provisions Big Beautiful Bill

Below is a chart comparing key tax provisions before and after the One Big Beautiful Bill Act (OBBBA)

was enacted on July 4, 2025.

IRS Identity Protection PIN can help avoid

fraud and tax-related identity theft

The IRS is reminding taxpayers they can get extra protection against identity theft during the 2024 tax season by joining the Identity Protection Personal Identification Number (IP PIN) program.

The IRS IP PIN is a special six-digit number available to anyone who has a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN) and it helps prevent criminals from filling fraudulent federal income tax returns or stealing refunds using taxpayer's personal information..

Federal DOL Reinstates Longstanding Independent Contractor Test

The U.S. Department of Labor (DOL) has published a final rule for independent contractor classification

under the federal Fair Labor Standards Act (FLSA). Beginning on March 11, 2024, the rule will effectively

reinstate the longstanding version of the “economic reality” test the DOL previously used.

FinCEN Removes Beneficial Ownership Reporting Requirements

FinCEN Removes Beneficial Ownership Reporting Requirements for U.S. Companies and U.S. Persons, Sets New Deadlines for Foreign Companies.

RMD Relief

Did you take a RMD between January 1, 2023 and July 31, 2023? Did you not need the funds? IRS Notice 2023-24 applies to you. You can roll these funds back into your retirement account by September 30, 2023.

Changes to Ohio CAT Tax Exclusion and Annual Minimum Tax Effective January 1, 2024 for Ohio Businesses

The purpose of this information release is to provide guidance to commercial activity tax (“CAT”) taxpayers following the recent enactment of Am. Sub. H.B. 33 of the 135th Ohio General Assembly.

ERC Eligibility Checklist

This checklist can help you quickly decide if a business or other organization may qualify for the Employee Retention Credit. This is a very technical area of the law, but this checklist includes the main eligibility factors. Answer these questions in numerical order to see if you may be eligible to claim the ERC.

IRS Direct Pay

Use this secure service to pay your taxes for Form 1040 series, estimated taxes or other associated forms directly from your checking or savings account at no cost to you.

Treasury Suspends CTA Enforcement

The Treasury announced it would no longer enforce the Corporate Transparency Act, nor enforce any penalties or fines associated with beneficial ownership reporting.